International Sea Freight Disruptions & Challenges As Of 2021

Ever since its outbreak, the ongoing pandemic of COVID-19 has exerted a profound impact on the seaborne trade, including containerized trade. We, as a moving company, are unfortunately dealing with its consequences and relatively our clients as well, especially those wishing to relocate their households abroad from Thailand. An international move is usually shipped through sea freight, the most cost effective and the preferred transportation by clients. However, due to the ongoing COVID-related challenges the international shipping/logistics industry is facing, we have been experiencing heavy port congestions worldwide, lack of equipment (driver shortage causing delayed container haulage transports), blank vessel/skipped routes (blank vessel), and so forth.

Ongoing Shipping Crisis And Current Situation

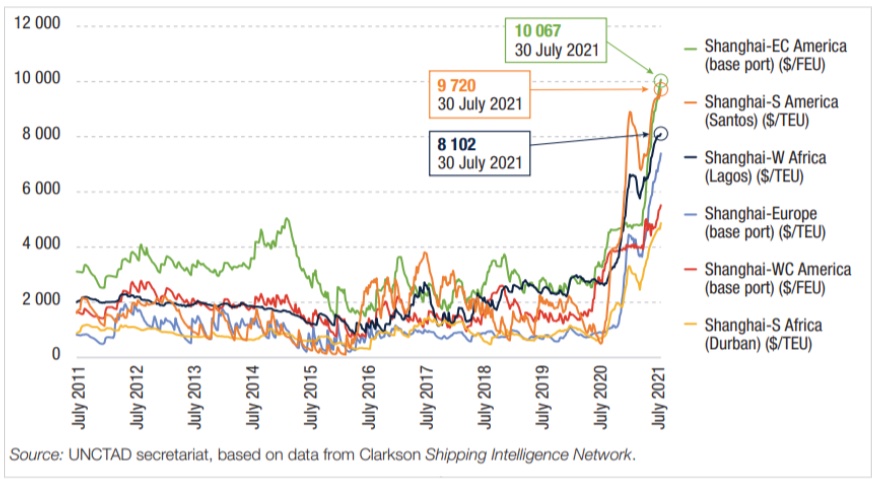

While China was the first country to recover from the pandemic, and the first to resume its import and export trade activities, other countries were still in lockdown. As a result, a considerable number of containers are stacking up at ports and importing countries are unable to return the containers to China. The lack of empty containers was compounded by carriers’ introduction of blank sailings, in which empty containers were left behind and were not relocated. Due to these obstacles, container dwell times at ports increased, and empty containers did not return to the system where they were most required. Thus, since the end of 2020 and throughout 2021, container shortages and congestion at ports, along with other disruption, led to an extreme levels of costs for sending containers with freight rates reaching new highs over that period, particularly on routes from China to Europe and the United States. The Shanghai Containerized Freight Index (SCFI) which includes cargo departing from Shanghai, China, reflects these trends (Figure 1).

On the Shanghai-Europe route, the freight rates given by SCFI indicated less than $1,000 per Twenty-foot Equivalent Unit (TEU) in June 2020, to $4,000 (USD/TEU) by the end of 2020 before climbing up to $7,395 (USD/TEU) by the end of July 2021, translating a surge of 639.5% from June 2020 to end July 2021.

On the China-United States trade lane, freight rates have also risen. The SCFI spot rate for the Shanghai- West Coast North America route reached approximately $4,500 per Forty-foot Equivalent Unit (FEU) in April 2021, up from $1,600 (USD/FEU) the previous year, then rose to $5,200 (USD/FEU) in July 2021. By the end of July 2021, the SCFI spot rates on the Shanghai-East Coast North America route had more than doubled, reaching $10,067 (USD/FEU).

The increase in spot freight rates was also felt in developing regions such as South America and Africa. The rates on the China-South America route was $959 (USD/TEU) in July 2020 but had risen to $9,720(USD/TEU) by the end of July 2021. Rates for the Shanghai to West Africa route increased from $2,672 (USD/TEU) to $8,102 (USD/TEU) within the same time period.

Driver Shortage And Lack Of Equipment

Haulage problems and shortage of Heavy Goods Vehicle (HGV) drivers across Europe, especially in the UK are becoming a serious issue affecting the shipping industry. Adding to the COVID-19 pandemic, Brexit is found to be responsible for this shortage of drivers.

With huge sectors of the economy shutting down and as travel became more and more restricted in 2020, many European drivers returned to their home countries. In 2021, a survey conducted by the Road Haulage Association (RHA) of its members indicated a shortfall of more than 100,000 qualified drivers in the UK, including thousands of drivers from member states of the European Union (EU) who used to live and work in the UK. Drivers used to be able to come and go as they pleased while the UK was a member of the EU single market, but that is no longer the case due to new immigration laws. Moreover, the new bureaucracy, the drop in the value of the pound against the euro since the Brexit, as well as tax changes has made working in the UK less appealing for EU nationals. The shortages in the rest of Europe are having a smaller impact on other nations than they are in the UK because they draw on a much wider pool of labor in the EU single market, where free movement is guaranteed, which is no longer conceivable in the UK.

The scarcity of HGV drivers, combined with congestion at container ports, are causing delays and aggravation at numerous ports across the UK, making it increasingly difficult for UK haulers to meet their delivery deadlines. Because Felixstowe and Southampton are the UK’s two main container ports, issues at any of them can have a domino effect on other ports in the Kingdom, noting that Felixstowe is already experiencing delays to shipment since 2018, owing to a large backlog of containers following the implementation of a new terminal operating system. In addition to road congestion, vehicle shortages (due

to a lack of drivers), and growing cargo volumes, the UK haulage industry is facing considerable challenges. Because of the rigorous schedules that ocean carriers must adhere to, some operators are leaving ports before all containers have been emptied or loaded, generating even more inconvenience and delays for shippers.

What To Expect In Q1/q2 2022

“Those looking for good shipping news anytime soon aren’t likely to receive it” – Jeff Cox, CNBC.

For trade credit insurer Euler Hermes, global supply chain disruptions may last until the second half of this year, since the new variant (omicron) might strike again, requiring new containment measures that would impede shipping operations and worsen the situation. In reference to some outbreaks last year, two of the world’s five busiest container ports (Shenzhen and Ningbo-Zhoushan, China) were closed, causing further delays. Chen, vice-chair at Wan Hai Lines, a Taiwanese shipping company explains that every time there is a COVID-related incident, it’s like a car accident that stops all lanes on a highway.

According to the port of Rotterdam, Europe’s largest port, the current container supply chain congestion is expected to persist through 2022. Hans Negtegaal, Director Containers Port of Rotterdam, explained that the lead time and also the dwell times on the terminals are both increasing, resulting in a large backlog. For example, the average dwell time for a container has moved from four to about seven days.

For Goldman economist Ronnie Walking, backlogs and higher shipping costs are expected to endure at least through the middle of 2022 because there is no immediate solution for the underlying supply-demand imbalance at US ports. Shipping a container through major US ports now takes three times as long as it did previously. According to Goldman Sachs, nearly one-third of containers at the Los Angeles and Long Beach ports lingered for more than five days before being sent out in September 2021.

However, respite may come after the holidays and the Lunar New Year as container traffic declines and shipping capacity is expected to rise as worldwide orders for new container ships reach record highs, accounting for 6.4 percent of the existing fleet (Euler Hermes).

Moreover, some executives and analysts believe that the congestion in the neighboring ports of Los Angeles and Long Beach, serving as the US gateway for Asian imports, might be the key to resolve the disruptions. Alan Murphy, an analyst at consultancy Sea-Intelligence, believes that if bottleneck in North America is resolved, there will be sufficient capacity for the remainder of the system, hence, lowering the freight shipping costs (if bottlenecks persist, freight costs will remain high).

How Is Usp Relocations Helping In This Situation

Our ability to create and sustain an expansive network of forwarders allow us to source and provide the best rates possible. Once a service is booked with us, we ensure to pre-book a vessel before we move onto the packing process to get the earliest dispatch when needed. Your move is our care, thus, we promise transparency regarding the moving cost. Simply put, we will inform you beforehand of the freight charges

as well as any additional cost imposed by the shipping lines with proof provided. However, the only charges that cannot be provided are those that cannot be foreseen such as the following, when applicable:

- Detention / Demurrage / Port congestion charges / Port Storage charges

- GRI (General Rate Increase) or any other surcharges imposed by shipping lines.

Furthermore, considering the current crisis in the shipping industry, and to lessen the costs our clients may have to pay, we have been offering groupage shipment options since the start of pandemic, mainly for clients wishing to relocate to some specific regions such as the United Kingdom, Western Europe (via Rotterdam), and Australia (depending on the volumes to be shipped). This has proved to be the best way for our customers to save cost on their international move from Thailand. As one of the few Bangkok movers able to offer this option, and if you are interested in sharing a container with other shippers, please contact us ( info@usprelocations.com ) and our relocation consultants will discuss this option with you in more details.

For a groupage shipment, we will basically co-load your shipment with other own customers of ours, in order for you to be able to share the freight cost and port terminal charges with other shippers. You will only pay for the actual volume and space you are using in the container. (Please refer to this article to learn more about it: Groupage Shipment – The best way to save money on your move).

REFERENCES/SOURCES

- Ongoing shipping crisis and current situation: UNCTAD

- Driver shortage and lack of equipment: BBC; Goods Logistics Group

- What to expect in Q1/Q2 2022: Seatrade Maritime News; CNBC; The Financial Times.