The global supply chain disruptions were said to persist through 2022. However, it was also said that respite may come after the holidays and the lunar new year. According to the Ningbo Containerized Freight Index (NCFI), the current index quotes 3677.7 points, down by 4.8% compared to last week.

By calculating and recording changes in container freight rates on 21 routes originating from Ningbo-Zhoushan port, the NCFI represents the fluctuation of freight rates in the worldwide container shipping industry. The market freight rates have been falling in 17 routes while four others remain high, sources said.

NCFI’s basis period is the 10th week of 2012 (March 3, 2012 – March 9, 2012), with a 1,000-point basis index.

Freight rates in decline as demand pulls back

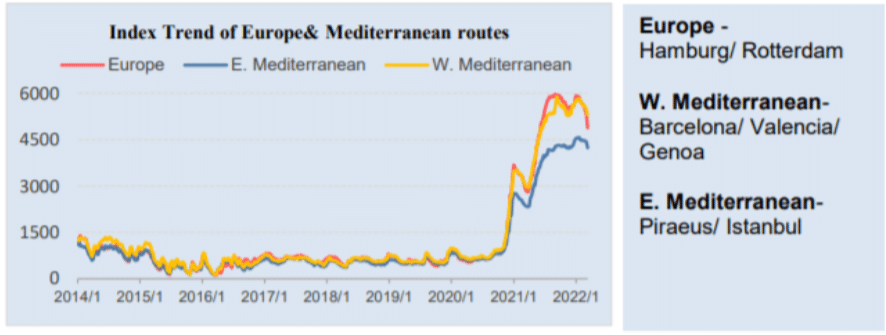

On the Europe and Mediterranean routes, the freight rates seem to be continuing its decline as most carriers increased their efforts to collect cargo, resulting in an insufficiency in the market regarding the overall cargo volume, thus, creating more shipping space on the route.

As of March 11th, the freight index regarding the route departing from Ningbo-Europe indicates 4877.8 points, falling by 8.6% from a week ago.

The route Ningbo-East Mediterranean shows 4236.5 points down by 4.5% while the route Ningbo-West Mediterranean also decreases from 5286.8 points by 3.4% compared to last week.

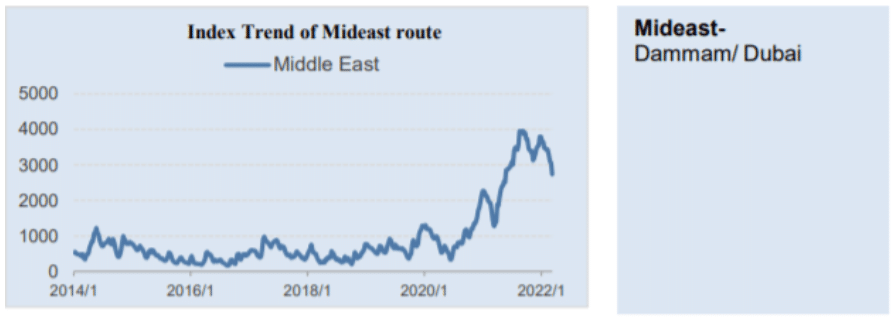

On the Mideast route, the market freight rate seems to have fallen rapidly, due to an intensified competition among carriers resulted from a sluggish transportation demand. The Mideast route have seen a decrease of 10.5%, down to 2736.4 points compared to a week ago.

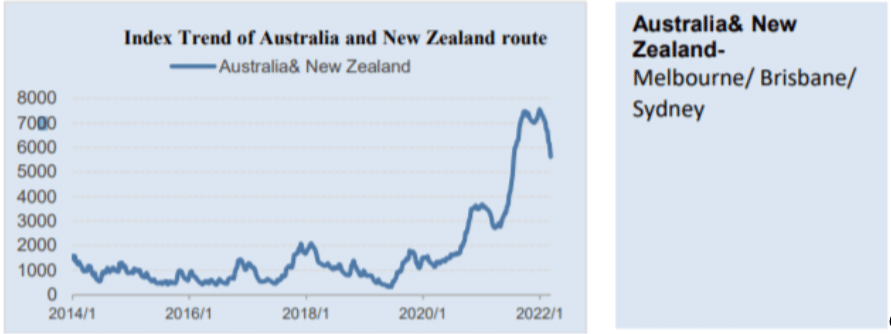

On the Australia and New Zealand route, the liner companies decided to lower prices to demand cargo, as the recovery of cargo volume was less than what was expected. The freight index regarding the route departing from Ningbo to Australia and New Zealand indicates a fall by 8.4% down to 5622.4 points compared to last week.

Weaker demand pressures Southeast Asian market

On route to North America, departing from the Southeast Asia region, a slight decline has been reported as well during the week of March 11th, due to a weak demand from US retailers.

Last week, as of 28th February’s week, rates were recorded at a range of $15,000-$18,000 (East Coast North America) and $13,000-$16,000 (West Coast North America), both for a 40ft container. As of March 11th, rates were in between $15,000-$16,000 for East Coast and $13,000-$15,000.

Despite the current weakness, market participants projected prices to rise towards the end of the month, owing to expected rises in stocks offtake.

Meanwhile, due to equipment shortages and increasing bunker fuel prices, rates on intra-Asia and short-haul trade routes remained stable amid the ongoing conflict between Russia and Ukraine.

Learn more about the impact the Russia-Ukraine war has over the shipping industry, ports, and air freight (insert a hyper link)

USP Relocations accentuate its Groupage offers

As an international moving company, this good news come as a long-awaited improvement of the situation.

With the current market freight rates that seem to be more and more favorable, we are working on more groupage shipment to even lower the freight rates to help our customers whenever they are moving out from Thailand to Europe, UK, and other destinations.

Although the downside being the transit time, the balance with the freight rates is most likely in favor as we have been covering several groupage shipments in the past few months.

If you are moving out of Thailand, from any cities within the Kingdom, we will be happy to assist you in your move/relocation, from pre-move inspection, packing until its delivery. If you are looking for a mover in Bangkok, Phuket, or any other provinces (we cover the entire Kingdom of Thailand), please feel free to get in touch with us!

Contact us now to get a free quote (info@usprelocations.com).

For any other inquiries, we are also available on Facebook, Line (@usprelocations and WhatsApp (+66 98-284-6984).